Crompton Greaves plan to cut debt makes analysts bullish on counter

By Narendra Nathan, ET Bureau|Mar 28, 2016, 08.00 AM IST

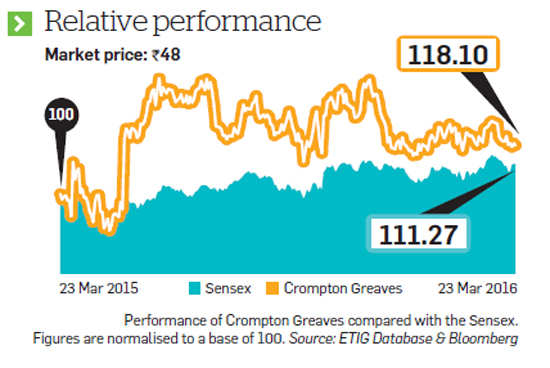

The demerger of Crompton Greaves' consumer products business is complete and the counter started trading (excluding the consumer business) from 15 March. It is quoting close to the value assigned by analysts to the demerged entity earlier.

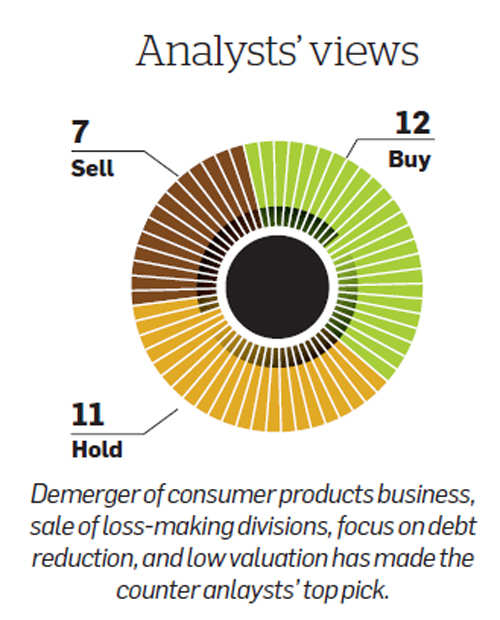

Now, because of several reasons, analysts are beginning to get bullish on this counter. First, because investors prefer focused companies over diversified ones. Most conglomerates quote at a discount to their sum-of-parts valuation, popularly known as conglomerate discount. The valuation discount for Crompton Greaves should also gradually go now.

Second, Crompton Greaves plans to reduce its loss-making overseas businesses and focus on domestic business. Since the domestic business is a cash generator, this should further help to improve its valuations. This is popularly known as tossing out-the-trash-and-keeping the-cash strategy. The first in line for sale is the company's international systems business. Though systems business contributed only 27% to its overseas revenue, it accounted for most of the company's overseas losses. The other two overseas businesses—automation and drives division—are making reasonable earnings before interest, taxes, depreciation and amortization margins of around 8% now. Once this division is sold, the company's loss from its international operations should come down by the second half of 2016-17.

Third, Crompton Greaves plans to use the money generated from overseas asset sales for debt reduction to become a completely debt-free company. The company management has already accepted a revised offer to sell its international power business for 115 million to First Reserve PE fund. The operational and organisational transition appears to be going on smoothly. The management has indicated that the company may go for further monetisation of assets in 2017-18 and, this, along with the positive cash flow from the domestic business, should make Crompton Greaves a cash-rich company by March 2018.

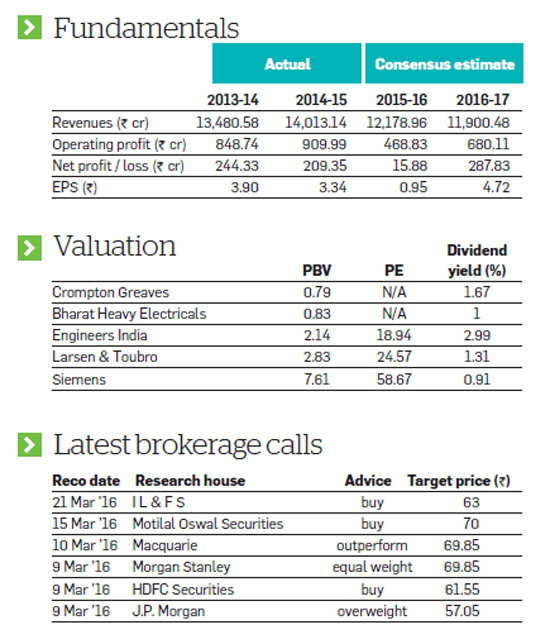

Currently, the counter is depressed because of concerns about overseas asset sales. Though things are expected to improve, low current margin is another factor pulling down valuations. As per consensus estimate, the company's earnings per share may jump to Rs 4.72 by March 2017. This means that the counter is trading only at a forward PE of 10.

Selection methodology: We pick the stock that has shown the maximum increase in 'consensus analyst rating' in the past one month. Consensus rating is arrived at by averaging all analyst recommendations after attributing weights to each of them (5 for strong buy, 4 for buy, 3 for hold, 2 for sell and 1 for strong sell) and any improvement in consensus analyst rating indicates that the analysts are getting more bullish on the stock. To make sure that we pick only companies with de ..

No comments:

Post a Comment