How Sanjiv Bajaj has created financial services supermarket

By Baiju Kalesh & Shilpy Sinha, ET Bureau | 7 Oct, 2015, 10.30AM IST

If in 2006, the startup mania was as crazy as it is in 2015, Sanjiv Bajaj may have been the first port of call for many private equity and venture funds. That was a time when a financial services conglomerate was being incubated in what was a one-trick pony — Bajaj Auto Finance, which lent money to buy motorcycles manufactured by Bajaj.

Nearly a decade after the Bajaj family split its auto and finance businesses and Bajaj Finserv, a journey back into the life of the company as well as its driver Sanjiv Bajaj reveals the skeptics have been wrong. You don't need to be a bank to build a financial services supermarket as visualised by Sandy Weil of Citigroup or KV Kamath in India; this may be possible even for a non-bank finance company.

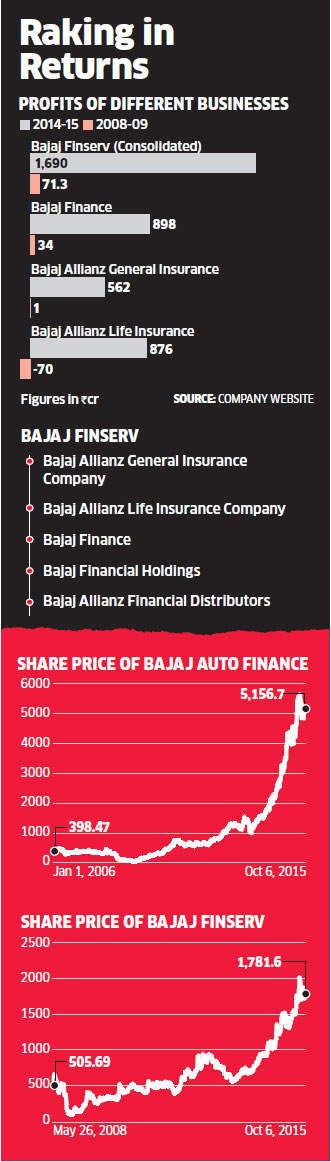

The narrative about wealth creation in India is often centered around Infosys Technologies or HDFC Bank, but it may well be extended to the startup of 2006 as well. Bajaj Finance has multiplied 112 times since 2006, and Bajaj Finserv, which owns stakes in insurance ventures, has gained 20 times. The benchmark Sensex has gained over 130 per cent in the period.

"We see Bajaj Finance as a missed opportunity," says Munish Dayal, partner Baring Private Equity Partners. "Bajaj Finance has an exceptional management team, excellent governance. It has invested in technology ahead of the curve.'' Non-banking finance companies in India have generally flourished as single segment businesses.

Building diversified businesses was a challenge both due to lack of expertise and regulatory issues. Bajaj Finserv was no exception. Sanjiv Bajaj has come a long way in turning around Bajaj Finserv in the last eight years, from a loss of Rs 32 crore in 2007-08 to a profit of Rs 1,690 crore in 2014-15, which essentially comprises a general and a life insurance business, and lending for consumers. The combined market capitalisation of Bajaj Finserv and lending arm Bajaj Finance is around Rs 55,000 crore, snapping at the heels of Bajaj Auto, which has a market cap of Rs 68,000 crore.

When there was a captive business in lending for Bajaj Auto's products, which provided assured business, what was the need to gamble with the other business for the younger of the two Bajajs after the auto business went to the older Rajiv Bajaj in the bifurcation of the family business? "When we started transforming Bajaj Auto Finance to Bajaj Finance, we decided to be multiline,'' said Sanjiv Bajaj in an interview on September 21. "There were many mono-line ones like Mahindra Finance, which were doing mainly tractors, Muthoot doing only gold. When we looked at private sector banks, we saw that if you do monoline they could wipe you out in a down cycle."

Bajaj could pat himself on the back for deciding to diversify given the fact that State Bank of India is getting more aggressive in lending for tractors, and the likes of HDFC are turning the heat on for the likes of Muthoot Finance with their gold loans. But Bajaj's vision is also accompanied by hiring some executives whose backgrounds were from a diversified finance company, mostly GE Capital. Rajeev Jain, MD and CEO of Bajaj Finance, is one among the 11 of the 41 top executives who are from GE Capital, which industrial conglomerate GE is shedding.

"They (investors) did not believe in the story then,'' says Jain. "Every company takes time to be discovered. At a fundamental level we were creating the only diversified non-bank finance company. I had difficulty saying that if banks can do multi-line, why can't I?" Today, 40 per cent of its business comes from consumer business and small and medium enterprises have a 50 per cent share in its lending portfolio.

In a way, Bajaj is styling his company on the lines of GE Capital, which the industrial behemoth GE under Jeff Immelt now wants to get rid of as it becomes bigger than the parent itself. "At this rate, in 10 years, GE Capital will account for 55 per cent of GE's profits, and over time it can account for the lion's share of GE's profitability, which would put into question what GE is really about,'' Professor Juan Pablo Vazquez Sampere of IE Business School in Madrid wrote in the Harvard Business Review.

That is exactly what Sanjiv Bajaj believes. That the financial supermarket that he is building can get only bigger even with it not being a bank. What better way than to imbibe the culture of the one you want to imitate.

Recently, Bajaj Finance had taken a team of 90 people to Dubai for strategising. And among the top speakers was Pramod Bhasin, a veteran GE hand. Also in store was a video film that delivered a pep talk from the man who made GE — Jack Welsh. "Any strategy must have an outcome in financial numbers," says Jain. "Out of the 90 people, 22 had worked with GE Money and so if GE Money had not gone shut we may not have been created.''

GE Money sold its mortgage and consumer business in India in 2013 to Magma Fincorp. The NBFC business has grown at 35 per cent on a compounded annual growth rate over seven to eight years. "Bajaj owns its customers unlike other NBFCs who rely on direct selling agents for indiscriminately going after growth," said Abizer Diwaji national head, financial services, EY. "This helps them cross sell products and have higher profitability."

The conservative approach has paid off in insurance as well. In the general insurance industry, Bajaj Allianz is one of the few companies to make an underwriting profit of Rs 83 crore and a profit of Rs 562 crore by focusing on retail. "As India is getting richer, people will buy more insurance," said Bajaj. "Ten years back nobody bought health and home owners' insurance. In next five years I see it becoming significant parts of insurance." Bajaj took a conscious decision to slow down in 2008, unlike most life insurance companies, which went overboard to gain market share. "You saw irrational competition in the short term,'' says Bajaj. "When business slowed down some companies threw money to get market share. People like us who are conservative slowed down," said Bajaj. That halved its gross premium income to Rs 6,017 crore in March 2015, from Rs 11,420 crore in March 2010. While it has lost its market share, it is still one of the most profitable companies generating Rs 876 crore of profit last fiscal.

Will Bajaj, who lost out on getting a bank licence, buy a bank? "Banks in general are highly opaque in our assessments in terms of transparency and governance," says Jain. "The banking system delivers 10 per cent ROE, the best banks delivers 20 per cent of ROE. We have set a target of 18-20 per cent ROE and have delivered over last five years. We are building a business for next 15 years.''

If not, how does Bajaj compete and grow in an industry which has seen unprecedented competition (23 new banks) in just about a year? "Growth is not a challenge, it is in building the right business in a healthy profitable manner," says Bajaj. "For us as part of integrity, it is important that people follow the culture we have set down, culture of transparency, culture of selling honest products to customers."

GE's Immelt may not have wanted to have a financing business bigger than itself, but Sanjiv Bajaj has everything to show that the finance business carved out of an automobile company could be more valuable than the parent

.

No comments:

Post a Comment